Simple Insights® de State Farm®

¿Estás buscando ayuda para proteger a tu familia, carros, vivienda y futuro? Has venido al lugar adecuado. Los artículos de Simple Insights se basan en más de 100 años de conocimiento de State Farm.

Tendencias

Autos y vehículos

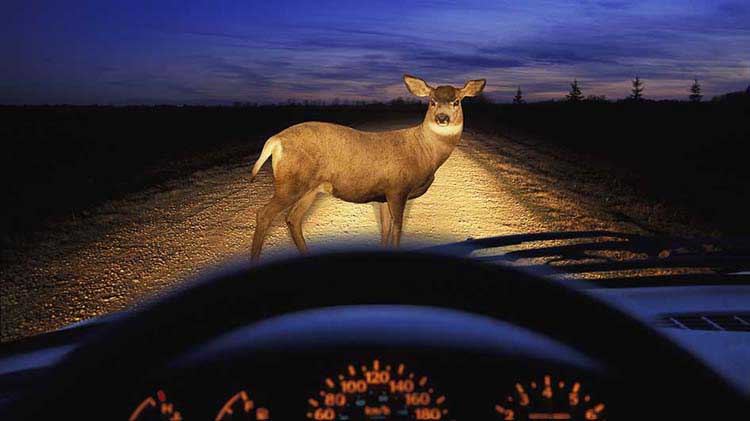

Qué hacer cuando chocas contra un venado

Aunque estés alerta, los choques entre automóviles y venados pueden suceder. Aprende lo que debes hacer continuación.

Residencia

Cómo prevenir que las tuberías se congelen

Considera estas ideas para ayudar a prevenir que las tuberías se congelen, y lo que podrías intentar si se congelan.

Autos y vehículos

¿Por qué están subiendo las tarifas de seguro de auto?

Las razones detrás del aumento de las primas del seguro de carros y cómo ayudarte a lidiar con ellas.

Autos y vehículos

¿Cuánta cobertura de seguro de carros necesito?

Aprende sobre límites de cobertura, seguro contra choques y cobertura amplia, deducibles y otros términos importantes para ayudarte a decidir cuánto te conviene y cómo puedes ahorrar.

Autos y vehículos

¿Qué afecta las tarifas del seguro de carros?

Conoce los factores que afectan las primas del seguro de carros y aprende cómo reducir los costos de seguro.

Autos y vehículos

¿Puedes manejar con seguridad bajo un clima severo?

Es útil saber cómo manejar de manera segura en hielo, nieve, lluvia, niebla y otras inclemencias del tiempo.

Autos y vehículos

¿Puedes realmente ahorrar si eliges una combinación de pólizas de seguro?

Es más que probable. Y los ahorros no son la única ventaja de combinar las pólizas de seguro.

Popular

Autos y vehículos

¿Puede otra persona manejar mi carro?

Descubre lo que pasa si otra persona maneja tu carro y tiene un accidente.

Residencia

Los pros y los contras de usar techos de metal para tu vivienda

Ya sea que estés comprando una vivienda con techo de metal o que estés pensando en instalarlo, he aquí lo que debes saber.

Autos y vehículos

Obtén un comprobante electrónico de la tarjeta de seguro

Puedes seguir rebuscando en la guantera. O puedes escoger una mejor opción: una tarjeta digital de seguro.

Residencia

¿Qué es el seguro de propietarios de vivienda y qué cubre?

Después de invertir en tu vivienda, es importante asegurarla debidamente. ¿Qué coberturas, formularios y exclusiones tienen estas pólizas?

Encuentra otros artículos por catergoría

Lo último

Residencia

Formas de ayudar a agregar valor a tu vivienda

Echa un vistazo a algunas formas de agregar valor a tu vivienda, ya sea que estés buscando quedarte en ella y hacerle mejoras, o bien renovarla y ponerla en venta.

Residencia

¿Cómo funciona el deducible de seguro de vivienda?

Conoce cómo el deducible de seguro de propietarios de vivienda elegido puede marcar la diferencia en tu prima de propietario de vivienda.

Residencia

Construir vs. comprar una vivienda: ¿Cuál opción es más económica?

¿Cuáles son los beneficios y costos relacionados con construir una vivienda nueva vs. comprar una ya construida?

Calculadoras

Estas calculadoras podrían darte más confianza en cuanto a tus decisiones financieras.

Autos y vehículos

Calcula la depreciación de tu vehículo

Determina cómo cambiará el valor de tu automóvil durante el tiempo que lo poseas usando esta herramienta.

Autos y vehículos

Consejos para ayudarte a decidir cuál préstamo para automóviles es la mejor opción

¿Vas a comprar un carro? Aquí tienes una calculadora para préstamos de carros para ayudarte a comparar préstamos y decidir cuál puede ser el mejor para ti.

Autos y vehículos

Calcula si es mejor comprar o arrendar un carro

Ingresa los detalles de las opciones de compra y arrendamiento para decidir si comprar o arrendar un carro es lo adecuado para ti.

Autos y vehículos

¿Debo financiar un carro o pagar en efectivo?

Esta calculadora para automóviles puede ayudarte a averiguar cuál podría ser la mejor opción para ti.

La información en este artículo se obtuvo de varias fuentes que no están relacionadas con State Farm® (incluyendo State Farm Mutual Automobile Insurance Company y sus subsidiarias y afiliadas). Aunque nosotros consideramos que es confiable y precisa; sin embargo, no garantizamos la precisión ni la confiabilidad de la misma. State Farm no se hace responsable y no endosa ni aprueba, implícita ni explícitamente, el contenido de ningún sitio de terceros vinculado por hiperenlace con esta página. La información no tiene la intención de reemplazar los manuales, las instrucciones ni la información provistos por el fabricante o el consejo de un profesional capacitado o de afectar la cobertura bajo cualquier póliza de seguro aplicable. Estas sugerencias no son una lista completa de todas las medidas de control de pérdida. State Farm no garantiza los resultados del uso de esta información.